Outdated or Unsupported Browser Detected

DWD's website uses the latest technology. This makes our site faster and easier to use across all devices. Unfortunatley, your browser is out of date and is not supported. An update is not required, but it is strongly recommended to improve your browsing experience. To update Internet Explorer to Microsoft Edge visit their website.

Unemployment Insurance (UI) Claimant Handbook

![]()

After you file your initial claim application for UI, you will receive a benefit computation in the mail. The benefit computation explains:

For more information about the information provided in the benefit computation, please see Qualifying Wages.

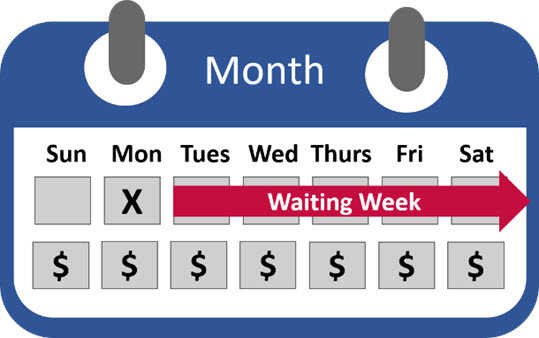

Wisconsin has a waiting week for UI. For every new benefit year, no UI is payable for the first week you would otherwise be eligible for UI. After the waiting week, UI benefit payments for later weeks are made within seven days after a weekly claim certification has been filed unless payment is delayed because the weekly claim certification is incomplete or if DWD needs to investigate an eligibility issue.

Example: John was laid off from his job on the first Monday of the month and filed an initial claim application for UI that same day. If John fulfills all eligibility requirements, he will receive his UI benefit payment for the next week. See Maintaining Your UI Eligibility for more details about the continuing eligibility requirements.

Do not expect to receive your UI benefit payments on the same day or within the same amount of time each week.

If you do not receive a payment (or an explanation for not receiving a payment) within seven days of filing a weekly claim certification, check the status of your payment on your Claimant Portal or call the Help Center at (414) 435-7069 or toll-free (844) 910-3661 during business hours.

If eligible, you may receive your UI benefit payments through direct deposit or a prepaid debit card. If you cannot or choose not to enroll in direct deposit, you will automatically receive payments by debit card. You can update your payment method at any time. To view or update your payment method, log on to https://my.unemployment.wisconsin.gov, select "Profile Settings," from the "My UI Home" menu, and edit "Payment Information."

This option puts your UI benefit payments directly into your banking account. You may enroll:

Your Direct Deposit Information only needs to be submitted once unless your bank information changes. You DO NOT need to resubmit a Direct Deposit Authorization each time you file for unemployment benefits.

For more information, please see the Direct Deposit FAQ.

If you do not have a bank account or prefer not to use direct deposit, your UI benefit payments will be deposited onto a Visa pre-paid debit card and will be immediately available after deposit. The card can be used anywhere that Visa debit cards are accepted. You can view payment status and your current balance, and even pay bills online. For more information, please see the Visa Pre-Paid Debit Card FAQ.

Your UI may be reduced under the following circumstances:

For more information, please review Unemployment Insurance Reductions.

Updated: November 6, 2024