Outdated or Unsupported Browser Detected

DWD's website uses the latest technology. This makes our site faster and easier to use across all devices. Unfortunatley, your browser is out of date and is not supported. An update is not required, but it is strongly recommended to improve your browsing experience. To update Internet Explorer to Microsoft Edge visit their website.

Answer: Under s. 102.04(1) (b) of the Act, an employer becomes subject to the Act and must carry a worker's compensation insurance policy if:

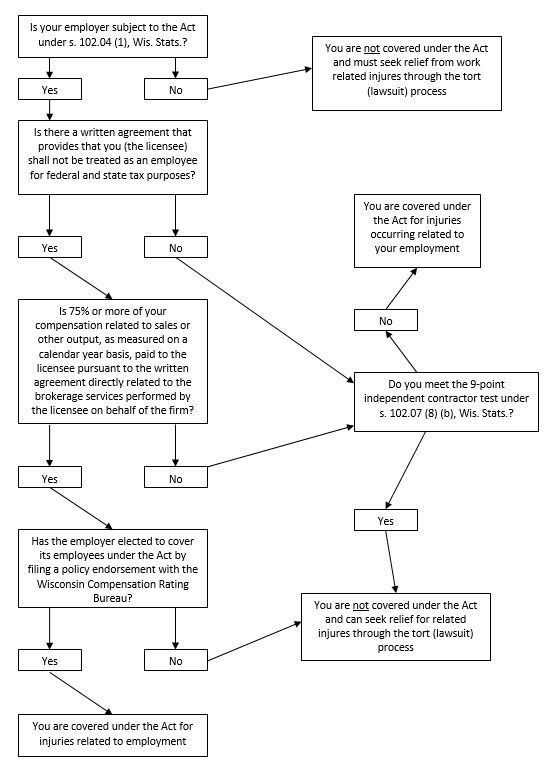

Answer: 2015 Wisconsin Act 258 created a separate specific employment definition under s. 452.38, Wis. Stats. for these workers.[1] If either of the two elements pursuant to s. 452.38, Wis. Stats., are not satisfied, a real estate broker, an agent or a salesperson working for a firm (licensed broker), who does not meet all elements of the 9-point independent contractor test under s. 102.07(8), Wis. Stats.,[2] is an employee of the firm under the Act and needs to be covered under a worker's compensation insurance policy. The independent contractor test under s. 102.07 (8) (b), Wis. Stats., will no longer be the sole test in determining whether real estate brokers, agents and salespersons are employees for worker's compensation purposes.

Answer: Yes, the 9-point independent contractor test is applicable to a real estate broker, agent or salesperson who is not excluded under ss. 102.07 (8) (bm) and 452.38, Wis. Stats.

Answer: Effective July 1, 2016, under s. 452.38, Wis. Stats., a licensee, including a real estate broker, an agent or a salesperson is not considered an employee of a firm under the Act if all of the following are satisfied:

(a) A written agreement has been entered into with the firm that provides that the licensee shall not be treated as an employee for federal and state tax purposes.

(b) Seventy−five percent (75%) or more of the compensation related to sales or other output, as measured on a calendar year basis, paid to the licensee pursuant to the written agreement referenced under par. (a) is directly related to the brokerage services[3] performed by the licensee on behalf of the firm.

Answer: Under s. 452.01 (5), Wis. Stats.,[4] a “Licensee” means any person licensed or registered under Chapter 452 (Chapter 452, Real Estate Practice), other than an inactive licensee registered under s. 452.12 (6).

Answer: Under s. 452.01 (7), Wis. Stats.,[5] a “Salesperson” means any person other than a broker or time−share salesperson who is employed by a broker.

Answer: "Broker" is defined under s. 452.01 (2), Wis. Stats.[6] See Endnote 7 for detailed definition.

Answer: Under s. 452.01 (4w), Wis. Stats.,[7] a “Firm” means a licensed individual broker acting as a sole proprietorship or a licensed broker business entity.

Answer: Yes, under s. 102.078 (1), Wis. Stats.,[8] a firm, as defined under s. 452.01 (4w) , may elect to name as its employee for purposes of this chapter a real estate broker, an agent or salesperson who is excluded under s. 452.38 by an endorsement on its policy of worker's compensation insurance or, if the firm is self-insured under s. 102.28 (2) (b), by filing a declaration with the Department of Workforce Development (the department) in the manner provided in s. 102.31 (2) (a)[9] [10] [11] [12] [13] naming the real estate broker, agent or salesperson as an employee of the firm for purposes of this chapter. A declaration under this subsection shall state all of the following:

(a) The name of the real estate broker or salesperson to be covered under this chapter.

(b) That a written agreement has been entered into that provides that the real estate broker or salesperson shall not be treated as an employee for federal and state tax purposes.

(c) That 75 percent (75%) or more of the compensation related to sales or other output, as measured on a calendar year basis, paid to the real estate broker, agent or salesperson under the written agreement specified in par. (b) is directly related to the brokerage services performed by the real estate broker or salesperson on behalf of the firm.

Answer: No, naming a real estate broker, agent or salesperson an employee for worker's compensation purposes does not make him or her an employee for unemployment insurance purposes.

Unemployment insurance law is separate and distinct from the worker's compensation law. The unemployment insurance law related to a licensed real estate broker, agent or salesperson is covered under s. 108.02 (15) (k) 7, Wis. Stats.

Answer: Effective July 1, 2016, an endorsement notification filing is made by the firm's insurance carrier to the Wisconsin Compensation Rating Bureau (WCRB).

The insurance carrier is required to file a WC 48 03 04 Wisconsin Real Estate Salespersons Endorsement with the WCRB. The endorsement allows a firm to elect coverage for these employees by providing payroll and a list of names to the insurance carrier for inclusion. A copy of the Wisconsin Real Estate Salespersons Endorsement can be found at Wisconsin Real Estate Salespersons Endorsement

Answer: Yes, under s. 102.078 (2), Wis. Stats., a firm, as defined in s. 452.01 (4w), may revoke a declaration under sub. (1) by providing written notice to the department in the manner provided in s. 102.31 (2) (a) and to the real estate broker, agent or salesperson named in the declaration. A revocation under this subsection is effective 30 days after the department receives notice of that revocation.

A firm must also notify its insurance carrier of the firm's intent to revoke the naming of a real estate broker, agent or salesperson as its employee for worker's compensation purposes under the firm's policy.

Answer: Generally, if there is a dispute regarding worker's compensation insurance coverage, remuneration and/or benefits, it is adjudicated by the State of Wisconsin Division of Hearing and Appeals on a case-by-case basis according to the facts and circumstances at the time of injury.

If the injured party is found to be an employee at the time of injury and the employer has a worker's compensation policy, the policy will cover any person working under the employer.

An employer, who does not have a worker's compensation insurance policy when they are required to under the Act, is subject to monetary penalties as defined in ss. 102.82 (2) (a) and 102.82 (2) (ag), Wis. Stats. The penalty for failure to carry worker's compensation insurance when required is twice the amount of premium not paid during an uninsured time period or $750, whichever is greater. In addition, if an employee is injured while working for an illegally uninsured employer, the uninsured employer is personally liable for reimbursement to the Uninsured Employers Fund (Fund) for benefit payments made by the Fund to the injured employee (or the employee's dependents). The penalties and reimbursements to the Fund are mandatory and non-negotiable.

Answer: If a firm is established in such a way that it is exempt from coverage under the Worker's Compensation Act, the firm forfeits the protection from civil liability related to an injury of an exempted worker.

A party may file a tort action (lawsuit) against the firm for negligence when injured while working for a firm. Neither the exclusive remedy[14] nor the limitations on certain wage and medical benefits afforded under the Act will apply to the claim under a lawsuit. In addition, an injured party may seek additional damages from the firm including pain and suffering.

Answer: Yes. If a firm's real estate brokers, agents and salespersons are excluded under the Act, the firm (employer) is still required to have worker's compensation insurance if subject to the Act under s. 102.04 (1), Wis. Stats.

If a firm employs staff who are not licensees under Chapter 452 and who do not meet the 9-point independent contractor test under s. 102.07 (8) (b), Wis. Stats., and the firm subject to the Act under s. 102.04 (1), Wis. Stats., the firm is required to have a worker's compensation insurance policy to cover its non-licensee employees.

Answer:

Answer: Yes, depending on their status under s. 452.38, Wis. Stats., s. 102.078 (1), Wis. Stats, and s. 102.07(8), Wis. Stats., there are four possibilities:

Answer: Yes, the Act provides protection to employers as well as workers. If an injury occurs in covered employment,[15] the worker is automatically entitled to certain wage and medical benefits. The worker, however, is limited to those benefits. A worker's compensation policy is the exclusive remedy for a covered claim--meaning an insured employer is protected from any lawsuits brought by an employee because of the work related illness or injury.

Answer: Contact the Wisconsin Department of Workforce Development - Worker's Compensation Division, Bureau of Insurance Programs in-person at GEF-1 State Office Building, 201 E. Washington Avenue, Madison by mail at P.O. Box 7901, Madison, WI 53707-7901 or by phone at (608) 266-3046. The Division also offers information online at: http://dwd.wisconsin.gov/wc

DWD is an equal opportunity employer and service provider. If you have a disability and need assistance with this information, please dial 7-1-1 for Wisconsin Relay Service. Please contact the Worker's Compensation Division at (608) 266-1340 to request information in an alternate format, including translated to another language.

Endnotes

[1]S. 452.38, Wis. Stats., Independent contractor relationship. (1) Except as otherwise provided in s. 102.078, a licensee shall not, under ch. 102, 103, 104, or 109, under subch. X of ch. 71 or subch. II of ch. 111, under any other law or rule other than those specified under sub. (1m), or in any action or proceeding under the common law, be considered an employee of a firm if all of the following are satisfied:

(a) A written agreement has been entered into with the firm that provides that the licensee shall not be treated as an employee for federal and state tax purposes.

(b) Seventy−five percent or more of the compensation related to sales or other output, as measured on a calendar year basis, paid to the licensee pursuant to the written agreement referenced under par. (a) is directly related to the brokerage services performed by the licensee on behalf of the firm.

[2]S. 102.07(8), Wis. Stats., (a) Except as provided in pars. (b) and (bm), every independent contractor is, for the purpose of this chapter, an employee of any employer under this chapter for whom they are performing service in the course of the trade, business, profession or occupation of such employer at the time of the injury.

(b) An independent contractor is not an employee of an employer for whom the independent contractor performs work or services if the independent contractor meets all of the following conditions:

(bm) A real estate broker or salesperson who is excluded under s. 452.38 is not an employee of a firm, as defined in s. 452.01 (4w), for whom the real estate broker or salesperson performs services unless the firm elects under s. 102.078 to name the real estate broker or salesperson as its employee.

[3]S. 452.01 (3e), Wis. Stats., "Brokerage service" means any service described under sub. (2) provided to a person by a firm and any licensees associated with the firm.

[4]S. 452.01 (5), Wis. Stats., "Licensee" means any person licensed or registered under this chapter.

[5]S. 452.01 (7), Wis. Stats., “Salesperson” means any person other than a broker or time−share salesperson who is employed by a broker.

[6]S. 452.01 (2), Wis. Stats., "Broker" means any person not excluded by sub. (3), who does any of the following:

(a) For another person, and for commission, money, or other thing of value, negotiates or offers or attempts to negotiate a sale, exchange, purchase, or rental of, or the granting or acceptance of an option to sell, exchange, purchase, or rent, an interest or estate in real estate, a time share, or a business or its goodwill, inventory, or fixtures, whether or not the business includes real property.

(b) Is engaged wholly or in part in the business of selling or exchanging interests or estates in real estate or businesses, including businesses' goodwill, inventory, or fixtures, whether or not the business includes real property, to the extent that a pattern of sales or exchanges is established, whether or not the person owns the real estate or businesses. Five sales or exchanges in one year or 10 sales or exchanges in 5 years is presumptive evidence of a pattern of sales or exchanges.

(bm) For another person, and for commission, money, or other thing of value shows real estate or a business or its inventory or fixtures, whether or not the business includes real property, except that this paragraph does not include showing a property that is offered exclusively for rent.

(h) For another person, and for commission, money, or other thing of value, promotes the sale, exchange, purchase, option, rental, or leasing of real estate, a time share, or a business or its goodwill, inventory, or fixtures, whether or not the business includes real property. This paragraph does not apply to a person who only publishes or disseminates verbatim information provided by another person.

S. 452.01(3), Wis. Stats., "Broker" does not include any of the following:

(a) Receivers, trustees, personal representatives, guardians, or other persons appointed by or acting under the judgment or order of any court.

(b) Public officers while performing their official duties.

(c) Any bank, trust company, savings bank, savings and loan association, insurance company, or any land mortgage or farm loan association organized under the laws of this state or of the United States, when engaged in the transaction of business within the scope of its corporate powers as provided by law.

(d) Employees of persons enumerated in pars. (a) to (c) and (f) when engaged in the specific performance of their duties as such employees.

(dm) Any employee of an attorney under par. (h) if all of the following are true:

1. The employee's activities are directly supportive of the attorney's provision of legal services to the attorney's client.

2. The employee's activities are activities that the attorney may perform under par. (h).

3. The employee is under the direction and supervision of the attorney.

(e) Any custodian, janitor, employee or agent of the owner or manager of a residential building who exhibits a residential unit therein to prospective tenants, accepts applications for leases and furnishes such prospective tenants with information relative to the rental of such unit, terms and conditions of leases required by the owner or manager, and similar information.

(f) Any credit union which negotiates loans secured by real estate mortgages or any licensee under ch. 138 which negotiates loans secured by real estate mortgages or any licensed attorney who, incidental to the general practice of law, negotiates or offers or attempts to negotiate a loan, secured or to be secured by mortgage or other transfer of or encumbrance on real estate.

(g) A person licensed as a mortgage banker under s. 224.72 who does not engage in activities described under sub. (2).

(h) Attorneys licensed to practice in this state while acting within the scope of their attorney's license.

[7]S. 452.01 (4w), Wis. Stats., "Firm" means a licensed individual broker acting as a sole proprietorship or a licensed broker business entity.

[8]S. 102.078, Wis. Stats., Election by real estate firm. (1) A firm, as defined in s. 452.01 (4w) , may elect to name as its employee for purposes of this chapter a real estate broker or salesperson who is excluded under s. 452.38 by an endorsement on its policy of worker's compensation insurance or, if the firm is self-insured under s. 102.28 (2) (b), by filing a declaration with the department in the manner provided in s. 102.31 (2) (a) naming the real estate broker or salesperson as an employee of the firm for purposes of this chapter. A declaration under this subsection shall state all of the following:

(a) The name of the real estate broker or salesperson to be covered under this chapter.

(b) That a written agreement has been entered into that provides that the real estate broker or salesperson shall not be treated as an employee for federal and state tax purposes.

(c) That 75 percent or more of the compensation related to sales or other output, as measured on a calendar year basis, paid to the real estate broker or salesperson under the written agreement specified in par. (b) is directly related to the brokerage services performed by the real estate broker or salesperson on behalf of the firm.

(2) A firm, as defined in s. 452.01 (4w), may revoke a declaration under sub. (1) by providing written notice to the department in the manner provided in s. 102.31 (2) (a) and to the real estate broker or salesperson named in the declaration. A revocation under this subsection is effective 30 days after the department receives notice of that revocation.

[9]S. 102.31 (2) (a), Wis. Stats., No party to a contract of insurance may cancel the contract within the contract period or terminate or not renew the contract upon the expiration date until a notice in writing is given to the other party fixing the proposed date of cancellation or declaring that the party intends to terminate or does not intend to renew the policy upon expiration. Except as provided in par. (b), when an insurance company does not renew a policy upon expiration, the nonrenewal is not effective until 60 days after the insurance company has given written notice of the nonrenewal to the insured employer and the department. Cancellation or termination of a policy by an insurance company for any reason other than nonrenewal is not effective until 30 days after the insurance company has given written notice of the cancellation or termination to the insured employer and the department. Notice to the department may be given by personal service of the notice upon the department at its office in Madison or by sending the notice to the department in a medium approved by the department. The department may provide by rule that the notice of cancellation or termination be given to the Wisconsin compensation rating bureau rather than to the department in a medium approved by the department after consultation with the Wisconsin compensation rating bureau. Whenever the Wisconsin compensation rating bureau receives such a notice of cancellation or termination it shall immediately notify the department of the notice of cancellation or termination.

(b) 1. In the event of a court-ordered liquidation of an insurance company, a contract of insurance issued by that company terminates on the date specified in the court order.

2. Regardless of whether the notices required under par. (a) have been given, a cancellation or termination is effective upon the effective date of replacement insurance coverage obtained by the employer, the effective date of an order under s. 102.28 (2) (b) exempting the employer from the duty to carry insurance under s. 102.28 (2) (a), or the effective date of an election by an employer under s. 102.28 (2) (bm) to self-insure its liability for the payment of compensation under this chapter.

[10]DWD 80.65 Notice of cancellation, termination, or nonrenewal. Notice of cancellation, termination, or nonrenewal of a policy under ss.102.31 (2) (a) and 102.315 (10), Stats., shall be given in writing to the Wisconsin compensation rating bureau, as defined in s. 626.02 (1), Stats., rather than the department. Whenever the Wisconsin compensation rating bureau receives notice of cancellation, termination, or nonrenewal pursuant to this section, it shall immediately notify the department of cancellation, termination, or nonrenewal.

[11]S. 102.31(1) (e), Wis. Stats., An insurer who provides a contract under par. (a) shall file the contract as provided in s. 626.35.

[12]S. 626.35 (1), Wis. Stats., Filing. An insurer who provides a contract under s. 102.31 (1) (a) or 102.315 (3), (4), or (5) (a) shall file with the bureau a copy of the contract, or other evidence of the contract as designated by the bureau, not more than 60 days after the effective date of the contract.

[13]S. 626.02 (1), Wis. Stats., "Bureau" means the Wisconsin compensation rating bureau provided for in s. 626.06

[14]S. 102.03 (2), Wis. Stats., Where such conditions exist the right to the recovery of compensation under this chapter shall be the exclusive remedy against the employer, any other employee of the same employer and the worker's compensation insurance carrier. This section does not limit the right of an employee to bring action against any coemployee for an assault intended to cause bodily harm, or against a coemployee for negligent operation of a motor vehicle not owned or leased by the employer, or against a coemployee of the same employer to the extent that there would be liability of a governmental unit to pay judgments against employees under a collective bargaining agreement or a local ordinance.

[15]S. 102.03 (1), Wis. Stats., Conditions of liability.

Liability under this chapter shall exist against an employer only where the following conditions concur:

(a) Where the employee sustains an injury.

(b) Where, at the time of the injury, both the employer and employee are subject to the provisions of this chapter.

(c) 1. Where, at the time of the injury, the employee is performing service growing out of and incidental to their employment.

2. Any employee going to and from their employment in the ordinary and usual way, while on the premises of the employer, or while in the immediate vicinity of those premises if the injury results from an occurrence on the premises; any employee going between an employer's designated parking lot and the employer's work premises while on a direct route and in the ordinary and usual way; any volunteer fire fighter, first responder, emergency medical technician, rescue squad member, or diving team member while responding to a call for assistance, from the time of the call for assistance to the time of their return from responding to that call, including traveling to and from any place to respond to and return from that call, but excluding any deviations for private or personal purposes; or any fire fighter or municipal utility employee responding to a call for assistance outside the limits of their city or village, unless that response is in violation of law, is performing service growing out of and incidental to employment.

3. An employee is not performing service growing out of and incidental to their employment while going to or from employment in a private or group or employer-sponsored car pool, van pool, commuter bus service, or other ride-sharing program in which the employee participates voluntarily and the sole purpose of which is the mass transportation of employees to and from employment. An employee is not performing service growing out of and incidental to employment while engaging in a program, event, or activity designed to improve the physical well-being of the employee, whether or not the program, event, or activity is located on the employer's premises, if participation in the program, event, or activity is voluntary and the employee receives no compensation for participation.

4. The premises of the employer include the premises of any other person on whose premises the employee performs service.

5. To enhance the morale and efficiency of public employees in this state and attract qualified personnel to the public service, it is the policy of the state that the benefits of this chapter shall extend and be granted to employees in the service of the state or of any municipality therein on the same basis, in the same manner, under the same conditions, and with like right of recovery as in the case of employees of persons, firms or private corporations. Accordingly, the same considerations, standards, and rules of decision shall apply in all cases in determining whether any employee under this chapter, at the time of the injury, was performing service growing out of and incidental to the employee's employment. For the purposes of this subsection no differentiation shall be made among any of the classes of employers enumerated in s. 102.04 or of employees enumerated in s. 102.07; and no statutes, ordinances, or administrative regulations otherwise applicable to any employees enumerated in s. 102.07 shall be controlling.

(d) Where the injury is not intentionally self-inflicted.

(e) Where the accident or disease causing injury arises out of the employee's employment.

(f) Every employee whose employment requires the employee to travel shall be deemed to be performing service growing out of and incidental to the employee's employment at all times while on a trip, except when engaged in a deviation for a private or personal purpose. Acts reasonably necessary for living or incidental thereto shall not be regarded as such a deviation. Any accident or disease arising out of a hazard of such service shall be deemed to arise out of the employee's employment.

(g) Members of the state legislature are covered by this chapter when they are engaged in performing their duties as state legislators including:

WKC-10466-P (R. 10/2024)